Annuity Income: Annuitization vs. Lifetime Withdrawal

During your working years, you're accustomed to living on an income from your job. When you retire, the income from employment ends. Social Security provides a steady income, but it probably isn't enough to meet your retirement income needs. An annuity is an option that can provide a steady stream of income during retirement. With most annuities, there are usually two choices available to generate a steady income: annuitization and lifetime withdrawals from a guaranteed lifetime withdrawal benfeit. Here's how each option works:

During your working years, you're accustomed to living on an income from your job. When you retire, the income from employment ends. Social Security provides a steady income, but it probably isn't enough to meet your retirement income needs. An annuity is an option that can provide a steady stream of income during retirement. With most annuities, there are usually two choices available to generate a steady income: annuitization and lifetime withdrawals from a guaranteed lifetime withdrawal benfeit. Here's how each option works:

Annuity

This is a fancy word to describe converting funds in an annuity into a stream of income for a fixed period or a lifetime. Often, once the annuity is annuitized, it can't be changed, reversed, or revoked — you're pretty much locked into the payments for the duration of time chosen. The amount of annuitization payments is based on several factors, including the duration of the annuity payments (either a fixed period or lifetime), the cash value of the annuity, current interest rates applied by the annuity issuer, and the age of the person (referred to as the "annuitant") over whose life the payments are based. With annuitization payments from nonqualified annuities (i.e., annuities funded with after-tax dollars), each distribution consists of two components: principal (a return of the money paid into the annuity) and earnings. The percentages of principal and earnings for each distribution will depend on the annuitization option chosen.

Guaranteed Lifetime Withdrawal Benefit

A guaranteed lifetime withdrawal benefit (GLWB) enables the annuity owner to receive payments without having to annuitize the annuity or give up access to remaining cash value in the annuity. Typically, an annual fee is charged for a GLWB. The amount of the GLWB payment is usually determined by applying a withdrawal percentage to the annuity's principal amount or cash value, whichever is greater at the time of election. The amount of each withdrawal is subtracted from the cash value. Generally, the amount of the withdrawal will not decrease, even if the cash value decreases or is exhausted. Optional benefits are available for an additional fee and are subject to contractual terms, conditions and limitations as outlined in the prospectus and may not benefit all investors.

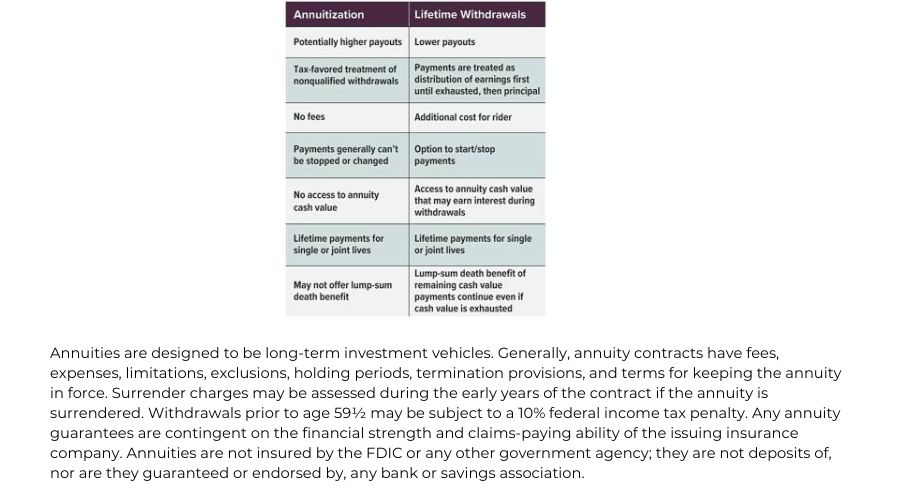

Annuitization vs Lifetime Withdrawal

IMPORTANT DISCLOSURES

The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.